- Obtain an NTN Number(National Tax Number) this number is mandatory to become a tax payer in Pakistan.

- You can easily obtain an NTN number by visiting a your legal adviser or through online process by visiting FBR website and making a request. Go to the site and then go to the Registration for Unregistered Person tab. It is a simple form. After filling it, NTN generates.

- NTN number takes a few hours and you will have a unique NTN number at your disposal but now government is working on converting CNIC as a NTN number.

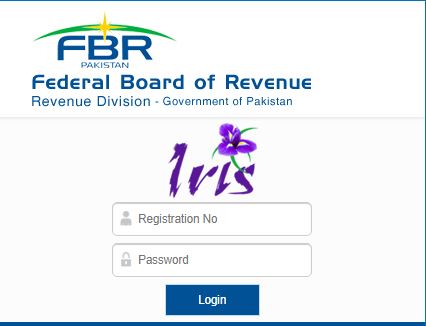

- IRIS Registration. Go to federal board of Revenue website and go to the IRIS tab. From there register yourself for e-enrollment.

Once registered you will receive a confirmation email.Then fill in the income details. You need to have all the relevant tax content available.Once you submit all the details, IRIS will confirm that you have now submitted.After successful submission, you get a confirmation email. Later you are active on the ATL listing.

Also read: Filer and Non-filer